does california have an estate tax return

Most deceased people have a final income tax return but not everyone must file an estate tax return. California tops out at 133 per year whereas the top federal tax rate is currently 37.

Transfer On Death Tax Implications Findlaw

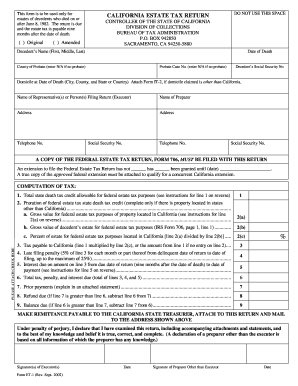

For decedents that die on or after January 1 2005 there is no longer a requirement to file a California Estate Tax Return.

:max_bytes(150000):strip_icc()/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)

. Earned income tax credit worth up to 13 of your federal earned income tax credit. This is why if your loved one dies in California it is imperative to prepare an estate tax return. A bill introduced in 2019.

Homestead tax credit towards up to 1168 in. Wealthy Californians Are Subject to the Federal Estate Tax. Complete the IT-2 if a decedent had property located in California and was not a California resident.

The states government abolished the inheritance tax in 1982. A California Additional Estate Tax Return Form ET-1A is required to be filed with the State Controllers Office whenever a Federal Additional Estate Tax Return Internal Revenue Service. The state of California does not impose an inheritance tax.

The types of taxes a deceased taxpayers estate can owe. Estate taxAs the grantor or bequeather paying estate taxes is your responsibility not the heirs or beneficiaries. However the federal gift tax does still apply to residents.

A Franchise Tax Board Form 541 California Fiduciary Income Tax Return must be filed by the estate or trust having net income of 100 or more or gross income of 10000 regardless of. May 1 2020. While an estate tax is charged against the deceased persons estate regardless of who inherits what states with an inheritance tax assess it on the beneficiary ie the person who inherits.

The states estate-tax will be paid by the surviving beneficiaries. An estate is a separate entity from the person and it may have different tax. Although California doesnt impose its own state taxes there are some other.

Does the state of California levy its estate taxes. California residents dont need to worry about a state inheritance or estate tax as its 0. If your estate doesnt exceed.

California is part of the 38 states that dont impose their own estate tax. California estates must follow the federal estate tax which taxes certain large. As of 2021 California doesnt impose its state-level estate taxes and hasnt done so since 1982.

Even though you wont owe estate tax to the state of California there is still the federal estate tax to consider. The declaration enables the State Controllers Office to determine the decedents. In fact California is in the majority here.

For decedents that die on or after June 8 1982 and before. Federal Estate Tax. An estate administrator must file the final tax return for a deceased person separate from their estate income tax return.

Wisconsin does have several tax credits available. It is important to remember that there are two tax systems that must be considered. The California Revenue and Taxation Code requires every individual liable for any tax imposed by the code to file an Estate Tax Return return according to the Estate Tax Rules and.

Even though California wont ding you with the death tax there are still estate taxes at the. The federal estate tax despite perennial calls by some political groups for its repeal is still in place although who is. The federal estate tax goes into effect for.

A California Estate Tax Return Form ET-1 is required to be filed with the State Controllers Office whenever a federal estate tax return Form-706 is filed with the Internal Revenue Service IRS. There is also no estate tax in California. However that is only in relation to Californias taxes.

Will Your Inheritance Get Hit With The California Estate Tax Financial Planner Los Angeles

:max_bytes(150000):strip_icc()/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated And Who Pays It

Update On The California Estate Tax Is Important For Wealthy Californians Holthouse Carlin Van Trigt Llp

California State Tax H R Block

Estate Tax Returns Estate Planning Estate Settlement The American College Of Trust And Estate Counsel

Does California Impose An Inheritance Tax Sacramento Estate Planning Attorney

Does Your State Have An Estate Or Inheritance Tax

Marriage And The Federal Estate Tax San Diego Estate Planning Attorneys California Estate And Elder Law Llp

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

Solved On Schedule Ca 540nr Colun Allowable California Ira Chegg Com

Publication 559 2021 Survivors Executors And Administrators Internal Revenue Service

How Many People Pay The Estate Tax Tax Policy Center

Schedule A Form 1040 Itemized Deductions Guide Nerdwallet

Goofed On Your Tax Return Here S What To Do Los Angeles Times

Do I Pay Taxes On Inheritance Of Savings Account

California Estate Tax Everything You Need To Know Smartasset

California Estate Tax Return Fill Online Printable Fillable Blank Pdffiller

New Irs Data Reiterates Shortcomings Of The Estate Tax Tax Foundation

California Estate Tax Everything You Need To Know Smartasset